AMC Entertainment Holdings, Inc. (AMC), a household name synonymous with movie theatres, has dominated the entertainment landscape for decades, boasting a vast cinema network across the US and internationally. However, beyond the silver screen, AMC Stock Fintechzoom offers a deeper dive into AMC’s financial well-being, analyzing its stock performance, current standing, and prospects to empower investors and enthusiasts alike.

As of April 2024, AMC’s stock has exhibited significant volatility, mirroring broader market trends while reflecting its unique industry position. Currently trading around $2.65, the stock has witnessed a noticeable decline, reflecting investor wariness and persistent challenges.

This downward trend isn’t isolated but somewhat influenced by industry-wide disruptions and shifting consumer preferences. The rise of streaming giants has become a formidable obstacle for traditional cinemas, forcing AMC to adapt strategically to economic pressures.

Mounting concerns about AMC’s financial stability have further fueled investor doubts. To navigate these challenges, AMC requires a multifaceted approach, including strategic decisions to stabilize its stock performance and regain stakeholder confidence.

AMC Stock Fintechzoom Performance

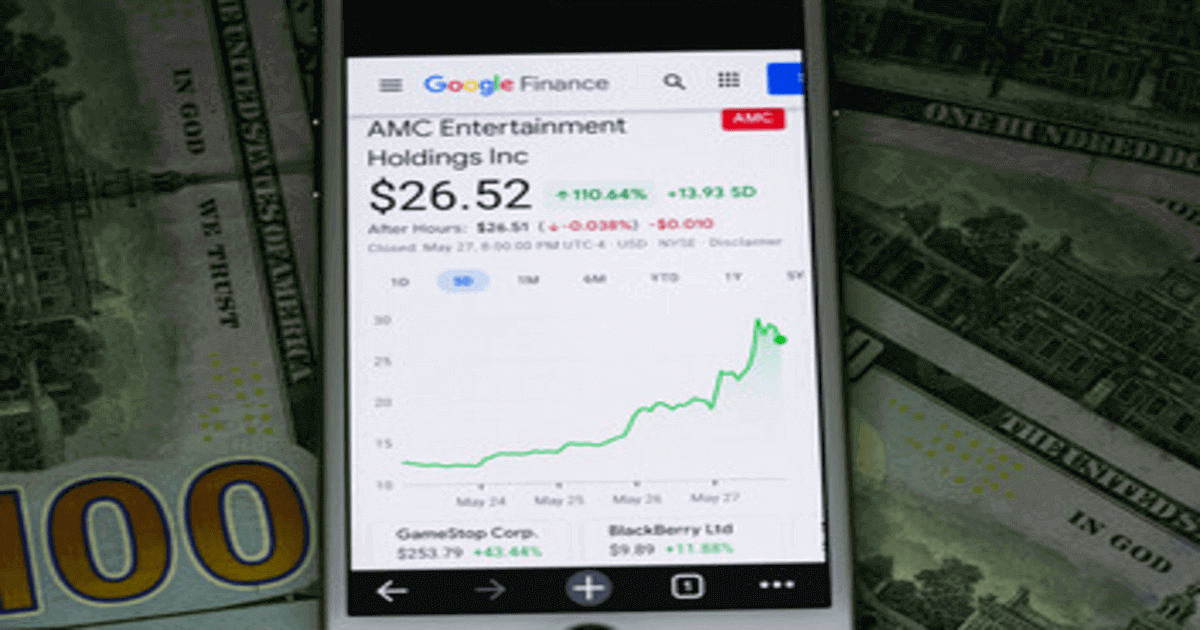

AMC’s stock has been a rollercoaster over the past year, captivating investors and analysts alike. AMC Entertainment Holdings, Inc. (AMC) shares have dramatically swung, defying a straight-line trajectory.

Starting 2023 on a high note, AMC’s stock soon embarked on a downward spiral, losing a staggering 56% to reach its current price of $2.65. This plunge, particularly pronounced in early 2024, coincided with a series of financial announcements by the company that reflected challenging market conditions.

Several key events have significantly affected AMC’s volatile stock performance. One crucial factor was the company’s decision to sell additional shares, a move aimed at boosting liquidity. However, this tactic, known as an at-the-market offering, diluted the value of existing shares, leading to a price drop. Additionally, AMC’s significant debt burden, coupled with the uncertain post-pandemic recovery of the cinema industry, has exerted continuous pressure on the stock.

Analyzing the Impact of Strategic Decisions

AMC took a proactive step to strengthen its financial position through a strategic at-the-market equity offering, raising much-needed liquidity. However, this move had an unintended consequence: stock price dilution. Existing shareholders saw their ownership percentages decrease due to increased shares, pushing the stock price downward.

AMC’s significant debt burden has been a primary concern for investors and analysts, limiting its financial flexibility and raising doubts about its ability to weather challenging market conditions. Consequently, investors are keenly focused on AMC’s debt management strategies, which are crucial for the company’s long-term health and stock performance.

The COVID-19 pandemic has significantly disrupted the cinema industry, and the recovery trajectory is uncertain despite reopenings and relaxed restrictions. As a significant player in this sector, these challenges directly impact AMC. Investor sentiment regarding the pace and extent of the industry’s recovery significantly influences AMC’s stock performance, with box office revenues and attendance figures being closely monitored as critical indicators.

Financial Analysis: AMC’s Performance in May 2024

This analysis dives into AMC’s recent performance, highlighting key metrics and future projections.

- Navigating Challenges: AMC’s earnings per share (EPS) reflects past difficulties. Despite these hurdles, improvements are evident. In 2022, EPS showed a loss of $2.37, which narrowed to $1.62 by 2023. This shift suggests cost-cutting and operational adjustments. Looking ahead, projections for 2025 anticipate a modest recovery, with EPS improving to -$0.81. This potential upswing is attributed to projected revenue growth reaching $5.17 billion.

- Investor Confidence: Analyzing the OPR (Opening Price Range) for May 2024 puts reveals investor confidence. As of April 18th, these options have yet to show significant changes, indicating stability. This stability suggests investor faith in AMC’s potential turnaround.

- Debt Burden: A significant concern for AMC remains its substantial debt of $4.5 billion by the end of 2023. Management is implementing strategies to mitigate this debt’s impact, including restructuring and potentially converting some debt into equity. However, this high debt significantly restricts AMC’s financial flexibility for future investments and business model expansion.

- Looking Ahead: AMC faces financial challenges but strives for stability and growth. The company is actively addressing its debt burden while implementing strategies to improve its financial health. Investors can gain valuable insights into AMC’s future performance and prospects by monitoring EPS trends and debt management efforts.

Analyzing AMC Stock Fintechzoom: Overview of AMC’s Current Situation

Fintechzoom analysts have grown increasingly pessimistic (Predominantly replaced with increasingly) about AMC stock, reflecting the company’s persistent challenges and unclear future in the rapidly changing entertainment industry. As of April 2024, five leading Fintechzoom analysts have unanimously labelled AMC stock a ‘Sell’. This bearish outlook stems from several hurdles AMC continues to face, including significant debt burdens, growing competition from digital streaming services, and a slow movie theatre attendance recovery.

Challenges Facing AMC

- High Debt Burden: AMC’s significant debt restricts investments in growth opportunities and limits its ability to adapt to changing market trends.

- Digital Streaming Threat: The rise of digital streaming services poses a significant challenge, as consumers increasingly favour the convenience of streaming content at home over traditional movie theatres.

- Slow Theater Recovery: Despite efforts to enhance the theatre experience, AMC’s attendance recovery could be faster, hindering revenue growth and prolonging financial difficulties.

Analysis of Price Targets

Analyst sentiment on AMC paints a varied picture. The average Fintechzoom price target of $6.35 suggests a potential surge of 139.62% from the current price of $2.65. However, individual analyst outlooks diverge significantly. Optimists predict a high of $12, while conservatives target a more modest recovery of $4.75.

Differing Views on AMC’s Prospects

Analysts diverge on AMC’s future. Optimists believe strategic initiatives to improve customer experience and diversify content could drive revenue growth and stabilize the stock price. Conversely, conservatives highlight inherent risks in AMC’s uncertain future, pointing to its lagging performance compared to industry benchmarks and broader markets over the past year. The prevailing sell recommendation suggests a need for more confidence in a swift turnaround. Analysts advise caution due to the stock’s high-risk nature and AMC’s persistent challenges. While strategic initiatives show potential, the overall sentiment remains cautious, urging investors to approach AMC carefully and be aware of current market dynamics.

AMC Entertainment Holdings, Inc. presents a complex investment labyrinth, offering potential rewards and significant risks. Recent market volatility and its meme stock status necessitate a measured approach for seasoned and fledgling investors.

Understanding the Meme Stock Phenomenon

AMC’s designation as a meme stock subjects it to erratic market swings driven by social media trends and retail investor sentiment, as opposed to traditional business fundamentals. While this can yield short-term gains, it also introduces substantial volatility, necessitating a cautious strategy for those seeking long-term stability.

Deciphering the Debt Enigma

A critical challenge for AMC is its towering debt burden. How management tackles this issue, whether through refinancing or restructuring, is pivotal. Investors must meticulously scrutinize financial disclosures and debt management strategies to assess AMC’s economic health and operational sustainability.

Charting a Course Through Industry Currents

The movie industry faces formidable headwinds from streaming platforms. However, AMC’s efforts to diversify revenue streams and enhance the movie-going experience can mitigate some of these threats. A clear understanding of industry dynamics is crucial for gauging AMC’s ability to weather this competitive storm and potentially resurge.

The post-pandemic era ushers in economic fluctuations and shifting consumer preferences, impacting AMC’s recovery path. A robust economic climate could benefit AMC as discretionary spending increases. Conversely, economic downturns could exacerbate its challenges. Investors must consider these macroeconomic variables to chart AMC’s trajectory effectively.

Decoding Analyst Insights

Analysts hold a bearish view of AMC, unanimously recommending a “Sell” position, reflecting widespread scepticism about its future. Considering market dynamics and strategic initiatives, investors should glean insights from these expert evaluations, which provide a potential roadmap for AMC’s performance.

Conclusion

This analysis of AMC Stock Fintechzoom delves into the company’s market position, stock behaviour, and financial well-being. Despite formidable obstacles, AMC navigates the dynamic entertainment industry, adapting to adversity. Investors and fans can leverage this information to make informed decisions and create a clearer picture of AMC’s market prospects.

AMC’s stock performance reflects a complex interplay of internal and external factors. Strategic manoeuvres like at-the-market offerings aim for immediate liquidity but may unintentionally impact shareholder value. High debt and post-pandemic cinema challenges also necessitate a cautious, adaptable approach. Investors remain vigilant as AMC tackles these uncertainties, assessing their strategies and industry developments to gauge prospects.

Astute consideration is crucial to navigating the complexities of AMC stock. Investors must consider all aspects, from meme stock volatility to debt management and industry headwinds. By embracing a holistic approach encompassing market sentiment and macroeconomic factors, investors can navigate with informed confidence, seizing opportunities while mitigating inherent risks.

FAQs

Q: What makes AMC Entertainment’s stock unique?

AMC’s stock presents a unique investment opportunity with high potential risks and rewards. External market forces and AMC’s internal strategic decisions both influence its price.

Q: Are there opportunities for gains with AMC stock?

A: Yes, there are opportunities for gains, especially if the company effectively navigates its challenges and executes its strategies successfully.

Q: What should investors consider before investing in AMC stock?

A: Investors should conduct thorough research and carefully assess their appetite for risk before considering investing in AMC stock, given the considerable risks involved.

You may Also Like:

FINTECHZOOM BA STOCK: A STRATEGIC ALLIANCE PROPELLING INVESTMENT IN AEROSPACE INNOVATION