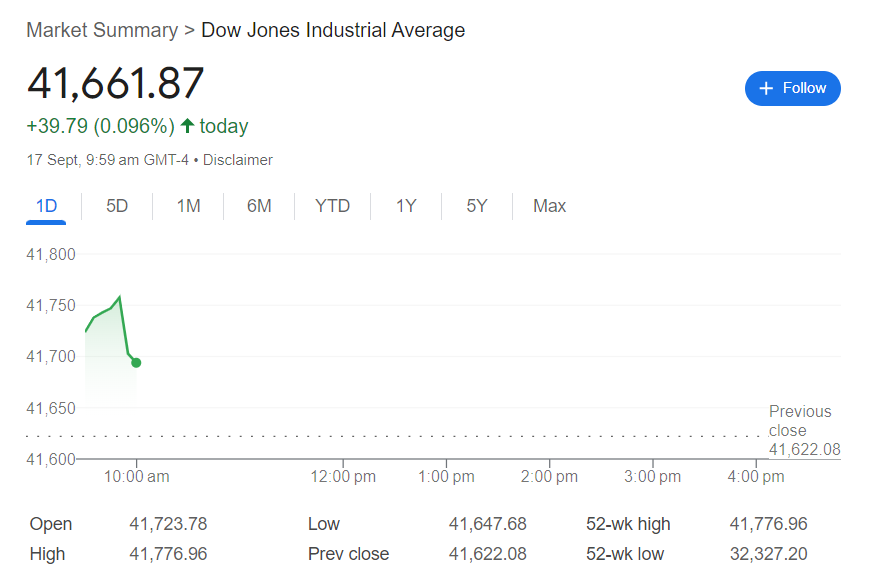

Today, the Dow Jones Industrial Average set a new record, closing 228 points higher, up by 0.6%, as traders anticipate a significant Federal Reserve meeting. The expectation is that the Fed may cut interest rates for the first time in years, contributing to the market’s positive movement. The S&P 500 also saw a slight rise, while the Nasdaq slipped 0.5%, impacted by declines in major tech stocks like Apple and Nvidia. This increase in the Dow reflects investor optimism despite recent economic uncertainties.

Stock Market News for Sep 17, 2024

NEW YORK — The Dow Jones Industrial Average set a record after a quiet Monday of trading, as Wall Street geared up for the most anticipated meeting of the Federal Reserve in years.

The Dow rose 228 points, or 0.6%, to surpass its prior all-time high set a few weeks ago. The S&P 500 index, which is much more comprehensive and widely followed on Wall Street, ticked up by 0.1% to climb within 0.6% of its own record set in July.

The Nasdaq composite slipped 0.5% as big technology stocks and other market superstars gave back a bit of their big gains from recent years.

Most stocks rose on Wall Street, and Oracle’s gain of 5.1% helped lead the market. The software company continued a strong run that began last week with a better-than-expected profit report.

Alcoa also jumped 6.1% after saying it would sell its ownership stake in a Saudi Arabian joint venture to Saudi Arabian Mining Co. for $950 million in stock and $150 million in cash. But drops for some influential Big Tech stocks kept indexes in check, including declines of 2.8% for Apple and 1.9% for Nvidia. They’re among the market’s most influential stocks because they’re among the largest by market value.

Stock indexes have been taking a jagged, scary ride toward their records. After worries about the U.S. economy and other hiccups in global markets briefly sent the S&P 500 nearly 10% below its all-time high last month, the S&P 500 is just one middling day away from its record on excitement about coming cuts to interest rates.

Treasury yields eased in the bond market ahead of Wednesday’s meeting for the Federal Reserve, where it’s expected to cut its main interest rate for the first time in more than four years.

Wall Street closed mixed on Monday ahead of the Fed’s crucial FOMC meeting this week. Market participants are overwhelmingly expecting the first rate to be initiated in September FOMC meeting. The Dow and the S&P 500 ended in positive territory while the Nasdaq Composite finished in negative zone.

How Did The Benchmarks Perform?

The Dow Jones Industrial Average (DJI) was up 0.6% or 228.30 points to close at 41,622.08, marking its new all-time closing high. Notably, 25 components of the 30-stock index ended in positive territory while 5 in negative zone. The blue-chip index posted a four-day winning run.

The tech-heavy Nasdaq Composite finished at 17,592.13, declining 0.5% due to weak performance by technology giants, especially AI-based semiconductor stocks. The tech-laden index terminated a five-day winning-streak.